The Procure-to-Pay Cycle (P2P)

The Procure-to-Pay Cycle is at the core of the activities of an organization. This cycle pertains to the procuring of goods so the organization can manufacture and deliver on time.

The cycle typically starts with the phase of Inventory Activity.

Inventory Activity

All manufacturing demands create purchase orders. First, a list of suppliers is created on the basis of criteria such as payment terms, quality, and shipment specifications.

Second, a Request for Quote (RFQ)/ RFI is raised. If the RFQ is accepted then the purchase order is prepared.

Besides the procurement of manufacturing materials other expense types such as purchase cards, travel and entertainment expenses could also exist. Items are ordered and received through subsystems and integrated with the main purchasing activity; thereby, providing for automatic payment through the cash-management system. Such expense types are designated as iExpenses.

In the case of the procurement of services the payment could be by the hour or according to a pre-determined fee.

This phase coincides with the next phase — Purchasing/Procurement.

Purchasing/Procurement

This phase is crucial to a manufacturing organization since both suppliers and resources that process transactions are obliged to follow guidelines. These guidelines ensure the creation and tracking of the purchase orders; and eventually culminate in the receipt and payment of purchases. The manufacturing organization establishes contracts with certain suppliers so that they adhere to the terms and conditions of procurement and payment.

The purchasing team sets the approval threshold and workflow on the basis of the management hierarchy (approval limits come into play here) so that the approval follows a certain path before the completion of the transaction.

When the goods reach the organization, the process of accounting begins.

Accounting for P2P

The following example illustrates the function of accounting vis-à-vis procurement.

APEX Engineering manufactures Ultra violet Air Purifiers and distributes only in West Virginia. Rob, the Sales Manager forecasts a sale of 1000 purifiers for the month of June 2014. He communicates this sales figure to Carlos, the Production Manager. Carlos determines the number of items of all material required based on the bill of materials and deducts the number of items that are already stocked in the warehouse. He, then, raises Purchase Orders for the rest of the items. The purchasing team places the Purchase Orders with APEX’s known suppliers and vendors.

So the flow looks something like this:

Sales Forecast results in requisitions –> Sourcing –> Quotation –> Auto create PO (if supplier exists) –> Purchase Orders

–> Receipt/Receiving –> create Invoice in AP –> Payment –> Post to GL

The terms of the suppliers are set up by the vendor maintenance team and accordingly the payment of the invoices after input is scheduled.

1) When using Oracle Applications (E-Business Suite) you can import requisition from integrated modules such as Inventory, Order Entry or MRP. Any shortfall in inventory will raise the appropriate requests to suppliers.

2) If the Inventory system is setup with default supplier you can auto create PO otherwise use “Oracle Sourcing” module to find the best supplier with optimized rates for your raw material.

3) If you are technical resource, remember the ‘PO_REQUISITIONS_INTERFACE_ALL’ table

4) Oracle sourcing is pretty neat – you can do RFQ’s, RFI’s and buyer’s auctions and it has the capability to integrate with other modules so that PO can be raised once the supplier is selected in the system.

5) Four different types of PO’s exist in Oracle Applications: Standard, Planned, Blanket and Contract.

6) Invoice creation impacts: PO_HEADERS_ALL, PO_LINES_ALL, PO_DISTRIBUTIONS_ALL , PO_LINE_LOCATIONS_ALL

7) There are three different receipts : Direct Receipt, Standard, Inspection Required

8) Receipt tables impacted: RCV_SHIPMENT_HEADERS, RCV_SHIPMENT_LINES

9) Invoice tables impacted in Payables:

- AP_INVOICES_ALL, AP_INVOICE_DISTRIBUTIONS_ALL, AP_AE_HEADERS_ALL, AP_AE_LINES_ALL, AP_ACCOUNTING_EVENTS_ALL

10) Payment Tables impacted:

- AP_CHECKS_ALL, AP_INVOICE_PAYMENTS_ALL, AP_CHECK_FORMATS, AP_BANK_BRANCHES, AP_TERMS, AP_PAYMENT_SCHEDULES_ALL, AP_BANK_ACCOUNTS_ALL

At the time of creating the purchase order, the General Ledger is not affected.

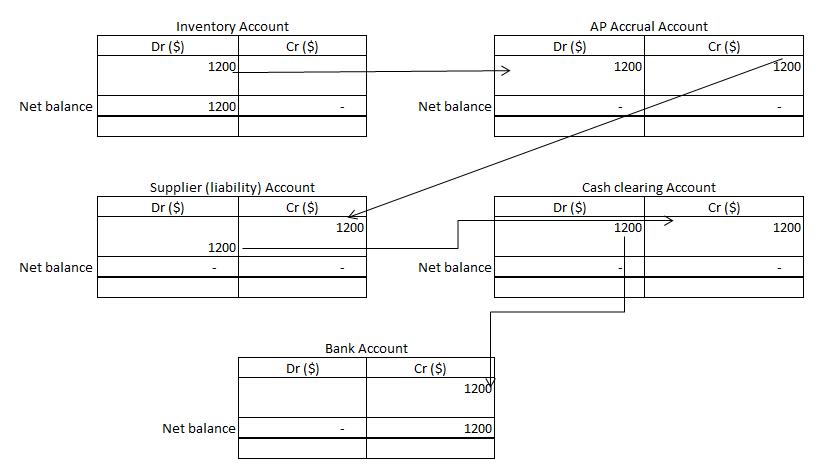

When APEX receives the ordered items, the following entry is made:

Dr Receiving Inventory Account

Cr Inventory Accounts Payable (AP) Accrual Account

When items are returned, the account is reversed to the extent of goods returned.

Accounting in the General Ledger can be classified as recording receipts, month-end accruals, invoices, and payments.

Payables

APEX creates the invoices for the goods received.

- When the invoice is input, the vendor account has to be credited.

Dr Inventory AP Accrual Account

Cr Liability Account

The expense items purchase can be recorded either on receipt or period-end.

Therefore, the entry for expense items will be:

Dr Receiving Inspection Account

Cr Expense AP Accrual Account

Expense recording at period-end as an accrual is done in two steps:

Dr Purchase Order (PO) Charge Account

Cr Expense AP Accrual Account

After the period-end, the entry is reversed.

Matching the PO with the invoice:

There are two, three and four ways of matching PO with invoice.

- In a two-way match, the price and quantity are matched.

- In Oracle Apps, when you match to a purchase order, Payables checks that the total of PO_DISTRIBUTIONS.QUANTITY_ORDERED = AP_INVOICE_DISTRIBUTIONS.QUANTITY_INVOICED

- In a three-way match, the quantity received is included for matching.

- In Oracle Apps, Payables checks QUANTITY_RECEIVED, if the RECEIPT_REQUIRED_FLAG =Y

- In a four-way match, the quantity accepted is also taken into consideration.

- In Oracle Apps, Payables checks QUANTITY_ACCEPTED, if the INSPECTION_REQUIRED_FLAG = Y.

Cash Management

The cash management team is responsible for reconciling the bank payments from the General Ledger (Accounts Payable) with the payments shown in the bank statements. For each payment, the team specifies the invoice for which payment is made and the Liability Account is given effect.

When the payment is made to the supplier, the Cash Clearing Account is used:

Dr Liability Account (Vendor Account)

Cr Cash Clearing Account

In case the automatic reconciliation of the bank statement with the Cash-Management System fails, the bank through which the payment has been made has to be specified in the Payables section. Thus, the bank account of APEX is credited and the Cash Clearing Account is debited.

Dr Cash clearing account

Cr Bank account

Other Aspects of the Procure-to-Pay Cycle

The following aspects could show up in the Procure-to-Pay Cycle:

- Purchase Order does not match the invoice: When Purchase Orders do not match the invoice; the guidelines that are set to hold the Purchase Order are followed. However, if the items received or the price is within the tolerance level, the Purchase Order is processed.

- Manual Payment: If the payment to the vendor does not happen automatically and instead, a check is delivered to the vendor, the amount remains in the Clearing Account. Subsequently, a match has to be done in the AP system to indicate that the payment that pertains to a particular invoice.

- Debit Memo/Credit Memo: The Debit Memo or Credit Memo is issued when there is either an over-payment or under recording of the vendor liability.

- Creation of Credit Memo

Dr Liability Account

Cr AP Accrual A/c/ Expense Account

- Refund through Credit Memo

Dr Liability Account

Cr AP Accrual/Charge Account

- Returns: Entries are recorded for goods that are returned.

- Goods returned to Supplier

Dr Liability Account

Cr Inventory/Expense AP Accrual account

- Prepaid Expenses

- Creation of Prepayment Invoice

Dr Prepaid Expense Account

Cr Liability Account

- Payment of Prepayment Invoice

Dr Liability Account

Cr Cash Clearing Account

- Apply Prepayment with Standard Invoice

Dr Liability Account

Cr Prepayment Account

Dynamics of Balance Sheet

At period-end the General Ledger team identifies the items in the Accrual Accounts and Contra Accounts. The AP or Expense Accrual Accounts consist of the amounts for which goods have been received or expenses have been accrued for the period. These will be reversed or cleared in the next accounting period when invoices are input and the liability to vendor is given effect.

Cash Clearing Account

While presenting financial statements, the cash clearing should be zeroed out. Manual entries into the General Ledger should be made such as deposits and payments. Therefore, while presenting the Cash Clearing Account the balance will not appear on the balance sheet. The items will instead be shown in the bank reconciliation statements.

Accrued AP/Expenses Payable

The balance in the Accrued AP/Expenses Payable is the total of the expenses that were incurred as of the date of the balance sheet, but were not entered into the General Ledger because an invoice has not been input or some expense has not yet been processed.

The amounts recorded in Accrued Expenses Payable will be based on estimates because the actual liability is not known as of the date of the balance sheet.

The accounting flow is shown below: